Discovering the Truth

Most Valuable Information

THE RIGHT NEWS

TODAY NEWS: SARKOZY GANG LOUVRE THEFT:

SARKOZY GANG LOUVRE THEFT:  A TRANSGENDER DEVIL KILLED CHILDREN AT A CATHOLIC SCHOOL IN MINNEAPOLIS:

A TRANSGENDER DEVIL KILLED CHILDREN AT A CATHOLIC SCHOOL IN MINNEAPOLIS:  RIGHT AFTER TAKEOFF, A BOEING CRASHED IN INDIA:

RIGHT AFTER TAKEOFF, A BOEING CRASHED IN INDIA:  POPE FRANCIS HAS DIED ON EASTER:

POPE FRANCIS HAS DIED ON EASTER:  COVID 19 TRUE ORIGINS 2025:

COVID 19 TRUE ORIGINS 2025:  SARKOZY GANG LOUVRE THEFT:

SARKOZY GANG LOUVRE THEFT:  A TRANSGENDER DEVIL KILLED CHILDREN AT A CATHOLIC SCHOOL IN MINNEAPOLIS:

A TRANSGENDER DEVIL KILLED CHILDREN AT A CATHOLIC SCHOOL IN MINNEAPOLIS:  RIGHT AFTER TAKEOFF, A BOEING CRASHED IN INDIA:

RIGHT AFTER TAKEOFF, A BOEING CRASHED IN INDIA:  POPE FRANCIS HAS DIED ON EASTER:

POPE FRANCIS HAS DIED ON EASTER:  COVID 19 TRUE ORIGINS 2025:

COVID 19 TRUE ORIGINS 2025:

SARKOZY GANG LOUVRE THEFT:

SARKOZY GANG LOUVRE THEFT:  A TRANSGENDER DEVIL KILLED CHILDREN AT A CATHOLIC SCHOOL IN MINNEAPOLIS:

A TRANSGENDER DEVIL KILLED CHILDREN AT A CATHOLIC SCHOOL IN MINNEAPOLIS:  RIGHT AFTER TAKEOFF, A BOEING CRASHED IN INDIA:

RIGHT AFTER TAKEOFF, A BOEING CRASHED IN INDIA:  POPE FRANCIS HAS DIED ON EASTER:

POPE FRANCIS HAS DIED ON EASTER:  COVID 19 TRUE ORIGINS 2025:

COVID 19 TRUE ORIGINS 2025:  SARKOZY GANG LOUVRE THEFT:

SARKOZY GANG LOUVRE THEFT:  A TRANSGENDER DEVIL KILLED CHILDREN AT A CATHOLIC SCHOOL IN MINNEAPOLIS:

A TRANSGENDER DEVIL KILLED CHILDREN AT A CATHOLIC SCHOOL IN MINNEAPOLIS:  RIGHT AFTER TAKEOFF, A BOEING CRASHED IN INDIA:

RIGHT AFTER TAKEOFF, A BOEING CRASHED IN INDIA:  POPE FRANCIS HAS DIED ON EASTER:

POPE FRANCIS HAS DIED ON EASTER:  COVID 19 TRUE ORIGINS 2025:

COVID 19 TRUE ORIGINS 2025: REAL NEWS

LATEST ARTICLES & ANALYSIS: YOU OWN THE LAND. YOU OWN THE OIL. YOU OWN THE COUNTRY.:

YOU OWN THE LAND. YOU OWN THE OIL. YOU OWN THE COUNTRY.:  HOW LONG UNTIL WHITES LOSE GLOBAL DOMINANCE? RISKS OF TARGETED COMPETITION:

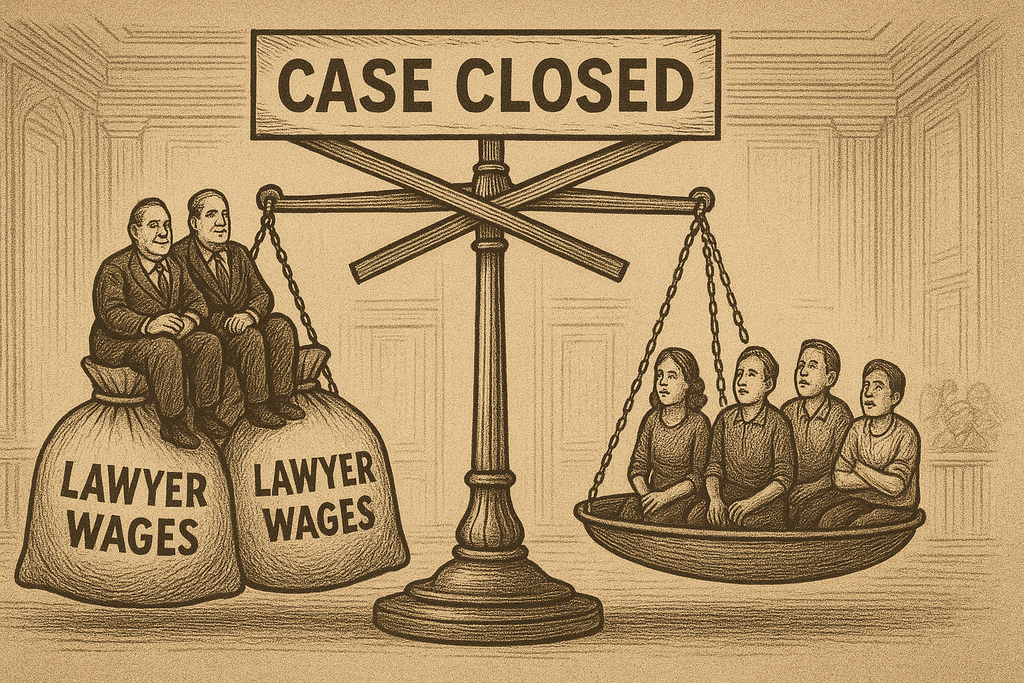

HOW LONG UNTIL WHITES LOSE GLOBAL DOMINANCE? RISKS OF TARGETED COMPETITION:  WHY POLITICIAN CORRUPTION ARRESTS AND ACCUSATIONS VARY IN REPORTING IN 2025:

WHY POLITICIAN CORRUPTION ARRESTS AND ACCUSATIONS VARY IN REPORTING IN 2025:  UNVEILED: NYT, WASHINGTON POST, CNN, AND POLITICO’S BIGGEST LIES FUELING MEDIA DISTRUST:

UNVEILED: NYT, WASHINGTON POST, CNN, AND POLITICO’S BIGGEST LIES FUELING MEDIA DISTRUST:  WHY GENDER IDENTITY IS RARELY A FOCUS IN ROUTINE HOMICIDE REPORTING UNLESS HIGH-PROFILE:

WHY GENDER IDENTITY IS RARELY A FOCUS IN ROUTINE HOMICIDE REPORTING UNLESS HIGH-PROFILE:  YOU OWN THE LAND. YOU OWN THE OIL. YOU OWN THE COUNTRY.:

YOU OWN THE LAND. YOU OWN THE OIL. YOU OWN THE COUNTRY.:  HOW LONG UNTIL WHITES LOSE GLOBAL DOMINANCE? RISKS OF TARGETED COMPETITION:

HOW LONG UNTIL WHITES LOSE GLOBAL DOMINANCE? RISKS OF TARGETED COMPETITION:  WHY POLITICIAN CORRUPTION ARRESTS AND ACCUSATIONS VARY IN REPORTING IN 2025:

WHY POLITICIAN CORRUPTION ARRESTS AND ACCUSATIONS VARY IN REPORTING IN 2025:  UNVEILED: NYT, WASHINGTON POST, CNN, AND POLITICO’S BIGGEST LIES FUELING MEDIA DISTRUST:

UNVEILED: NYT, WASHINGTON POST, CNN, AND POLITICO’S BIGGEST LIES FUELING MEDIA DISTRUST:  WHY GENDER IDENTITY IS RARELY A FOCUS IN ROUTINE HOMICIDE REPORTING UNLESS HIGH-PROFILE:

WHY GENDER IDENTITY IS RARELY A FOCUS IN ROUTINE HOMICIDE REPORTING UNLESS HIGH-PROFILE:

YOU OWN THE LAND. YOU OWN THE OIL. YOU OWN THE COUNTRY.:

YOU OWN THE LAND. YOU OWN THE OIL. YOU OWN THE COUNTRY.:  HOW LONG UNTIL WHITES LOSE GLOBAL DOMINANCE? RISKS OF TARGETED COMPETITION:

HOW LONG UNTIL WHITES LOSE GLOBAL DOMINANCE? RISKS OF TARGETED COMPETITION:  WHY POLITICIAN CORRUPTION ARRESTS AND ACCUSATIONS VARY IN REPORTING IN 2025:

WHY POLITICIAN CORRUPTION ARRESTS AND ACCUSATIONS VARY IN REPORTING IN 2025:  UNVEILED: NYT, WASHINGTON POST, CNN, AND POLITICO’S BIGGEST LIES FUELING MEDIA DISTRUST:

UNVEILED: NYT, WASHINGTON POST, CNN, AND POLITICO’S BIGGEST LIES FUELING MEDIA DISTRUST:  WHY GENDER IDENTITY IS RARELY A FOCUS IN ROUTINE HOMICIDE REPORTING UNLESS HIGH-PROFILE:

WHY GENDER IDENTITY IS RARELY A FOCUS IN ROUTINE HOMICIDE REPORTING UNLESS HIGH-PROFILE:  YOU OWN THE LAND. YOU OWN THE OIL. YOU OWN THE COUNTRY.:

YOU OWN THE LAND. YOU OWN THE OIL. YOU OWN THE COUNTRY.:  HOW LONG UNTIL WHITES LOSE GLOBAL DOMINANCE? RISKS OF TARGETED COMPETITION:

HOW LONG UNTIL WHITES LOSE GLOBAL DOMINANCE? RISKS OF TARGETED COMPETITION:  WHY POLITICIAN CORRUPTION ARRESTS AND ACCUSATIONS VARY IN REPORTING IN 2025:

WHY POLITICIAN CORRUPTION ARRESTS AND ACCUSATIONS VARY IN REPORTING IN 2025:  UNVEILED: NYT, WASHINGTON POST, CNN, AND POLITICO’S BIGGEST LIES FUELING MEDIA DISTRUST:

UNVEILED: NYT, WASHINGTON POST, CNN, AND POLITICO’S BIGGEST LIES FUELING MEDIA DISTRUST:  WHY GENDER IDENTITY IS RARELY A FOCUS IN ROUTINE HOMICIDE REPORTING UNLESS HIGH-PROFILE:

WHY GENDER IDENTITY IS RARELY A FOCUS IN ROUTINE HOMICIDE REPORTING UNLESS HIGH-PROFILE: THE LEFT NEWS

FEATURED UPDATES: AXIOS MISFRAMES MURDER AS MAGA NARRATIVE

AXIOS MISFRAMES MURDER AS MAGA NARRATIVE AXIOS MISFRAMES MURDER AS MAGA NARRATIVE

AXIOS MISFRAMES MURDER AS MAGA NARRATIVE KILLING CHRISTIANS AND JEWS

KILLING CHRISTIANS AND JEWS KILLING CHRISTIANS AND JEWS

KILLING CHRISTIANS AND JEWS SIT AMET CONSECTETUR

SIT AMET CONSECTETUR SIT AMET CONSECTETUR

SIT AMET CONSECTETUR ADIPISCING ELIT SED

ADIPISCING ELIT SED ADIPISCING ELIT SED

ADIPISCING ELIT SED SARKOZY GANG LOUVRE THEFT

SARKOZY GANG LOUVRE THEFT SARKOZY GANG LOUVRE THEFT

SARKOZY GANG LOUVRE THEFT

AXIOS MISFRAMES MURDER AS MAGA NARRATIVE

AXIOS MISFRAMES MURDER AS MAGA NARRATIVE AXIOS MISFRAMES MURDER AS MAGA NARRATIVE

AXIOS MISFRAMES MURDER AS MAGA NARRATIVE KILLING CHRISTIANS AND JEWS

KILLING CHRISTIANS AND JEWS KILLING CHRISTIANS AND JEWS

KILLING CHRISTIANS AND JEWS SIT AMET CONSECTETUR

SIT AMET CONSECTETUR SIT AMET CONSECTETUR

SIT AMET CONSECTETUR ADIPISCING ELIT SED

ADIPISCING ELIT SED ADIPISCING ELIT SED

ADIPISCING ELIT SED SARKOZY GANG LOUVRE THEFT

SARKOZY GANG LOUVRE THEFT SARKOZY GANG LOUVRE THEFT

SARKOZY GANG LOUVRE THEFT| Last week's most popular | Next week's most popular | |

|---|---|---|

| Keywords | Trump Cabinet Picks, Texas Flooding, Fed Rate Cut | Trump Inauguration Prep, DOGE Cuts, Bitcoin $110K |

| Events | Senate Confirmation Hearings Begin, Devastating Texas Flash Floods, December Fed Meeting Rate Decision | Trump Transition Team Finalizes Cabinet, DOGE Announces First Agency Cuts, Bitcoin Hits New All-Time High |

| Quotes | "Quantitative tightening ends December 1—that’s a de facto easing." – Cathie Wood | "The swamp is being drained faster than anyone expected." – Elon Musk |